The current cash debt coverage ratio is a liquidity ratio that measures the efficiency of an entity’s cash management. The cash coverage ratio measures the number of dollars of operating cash available to pay each dollar of interest expenses and other fixed charges. In the scenario above, the bank would want to run the calculation again with the presumed new loan amount to see how the company’s cash flows could handle the added load. Too much of a decrease in the coverage ratio with the new debt would signal a greater risk for late payments or even default.

Great! The Financial Professional Will Get Back To You Soon.

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

How confident are you in your long term financial plan?

A ratio of 1 means that the company has the same amount of cash and equivalents as it has current debt. In other words, in order to pay off its current debt, the company would have to use all of its cash and equivalents. A ratio above 1 means that all the current liabilities can be paid with cash and equivalents. A ratio below 1 means that the company needs more than just its cash reserves to pay off its current debt. Most companies list cash and cash equivalents together on their balance sheet, but some companies list them separately.

What is a good current cash debt coverage ratio?

- The current cash debt coverage ratio also represents a quantitative value that gauges the liquidity of a company.

- He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- They were diligent and forthright on both accounts and brought our deal to a successful closing.

- For better financial statement accuracy, it’s always better to use accounting software to manage your financial transactions.

- A ratio of 1 or higher is generally considered satisfactory, but higher ratios may be more favorable in certain industries or for companies with a higher risk profile.

- A coverage ratio is a metric that measures a company’s ability to service its debt and meet its financial obligations, including its interest payments and dividends.

It is frequently used by long-term creditors and bondholders to assess whether a company generates enough earnings to cover its total interest costs over time. The accumulated depreciation and depreciation expense is not a ratio typically run by a small business bookkeeper. If you’re a sole proprietor or a very small business with no debt on the books, other accounting ratios are much more useful, such as current ratio or quick ratio. Once you’ve calculated EBIT, you‘ll need to add back any depreciation or amortization expenses. For example, if your EBIT number is $60,000, and your depreciation expense is $4,000, the total you’ll use to calculate your cash coverage ratio is $64,000. Investors also want to know how much cash a company has left after paying debts.

The cash coverage ratio is a metric that helps entities calculate the ability to make interest payments using existing cash. This ratio calculates the ability of a company to cover interest expenses from its profits. When obtaining finance, most lenders consider the coverage ratios before deciding.

Conversely, when the cash coverage ratio number is less than 1 means the company’s total cash can not cover its interest expenses. The value of 1.00 of the cash coverage ratio means the company has the cash and cash equivalent equal to the interest expenses. Thus, the higher value of the cash coverage ratio, the more cash available for the interest expenses, and vice versa. A good ratio indicates that a company can service the interest on its debts using its earnings or has shown the ability to maintain revenues at a consistent level. A well-established utility will likely have consistent production and revenue, particularly due to government regulations. Even if it has a relatively low ratio, it may reliably cover its interest payments.

You will find one of several online cash coverage ratio calculators here. ABC Co. reported Earnings Before Income and Taxes (EBIT) of $40 million in its income statement. The company’s non-cash expenses for the period amounted to $10 million.

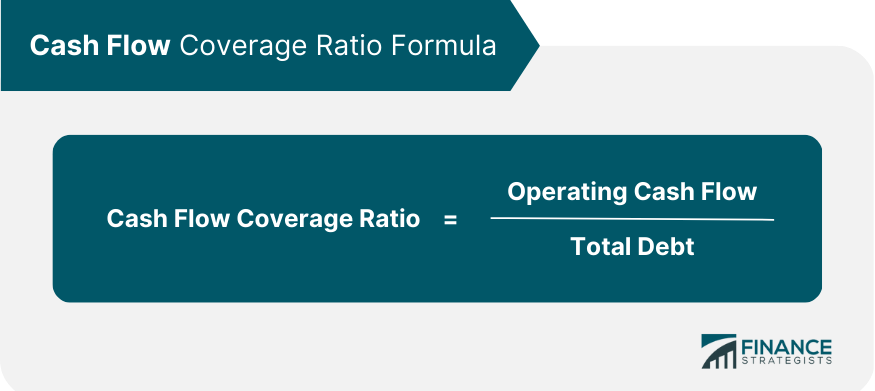

It’s important to keep in mind that the cash coverage ratio should be evaluated in the context of the specific industry and company’s financial situation. A ratio of 1 or higher is generally considered satisfactory, but higher ratios may be more favorable in certain industries or for companies with a higher risk profile. In the case of Company Z, the cash coverage ratio of 5.83 suggests strong financial stability and a low risk of default on its debt obligations. The cash coverage ratio is calculated by adding cash and cash equivalents and dividing by the total current liabilities of a company. One such measurement the bank’s credit analysts look at is the company’s coverage ratio. To calculate, they review the statement of cash flows and find last year’s operating cash flows totalled $80,000,000 and total debt payable for the year was $38,000,000.

Since this ratio primarily focuses on interest expense and cash resources, it can indicate financial difficulties. It is similar to the interest coverage ratio, which examines whether companies can repay the interest expense. The cash coverage ratio focuses on whether companies have enough cash resources to cover interest payments. It looks at whether a company can repay its entire debt service from its profits. There is no standard or acceptable amount of operating cash flow since it can vary by business; however, its value should exceed the average current liabilities balance. When the cash coverage ratio value is more than 1 means the company has the cash available more than the interest expenses.